Do-it-yourself or DIY investing has never been easier. If you have access to the internet and aren’t afraid of technology, then you’ve got a chance to earn money on your savings like the 1% (buzz word for the super wealthy). In this multi-part series I’m going to show you how to invest in stocks, bonds, and index funds the easy way so that you can get your money earning more money. Here’s what you need to know before you start DIY investing.

1. Get debt free (except your mortgage)

First of all, you need to be out of debt except for a possible mortgage on your house. If you have any debt (credit card, personal loans, student loans), you need to take the money you’ve saved and pay that off first. It’s a guaranteed return on your money. What does that mean? If your credit card interest rate is 14.99%, whatever you pay off on that card, you’re essentially earning 14.99% back by not having to pay that interest. Debt is negative interest on your money. Paying it off is a guaranteed return. Even a 4% guaranteed return is better than trying to cover that debt by earning more in the market. Pay off your debts first.

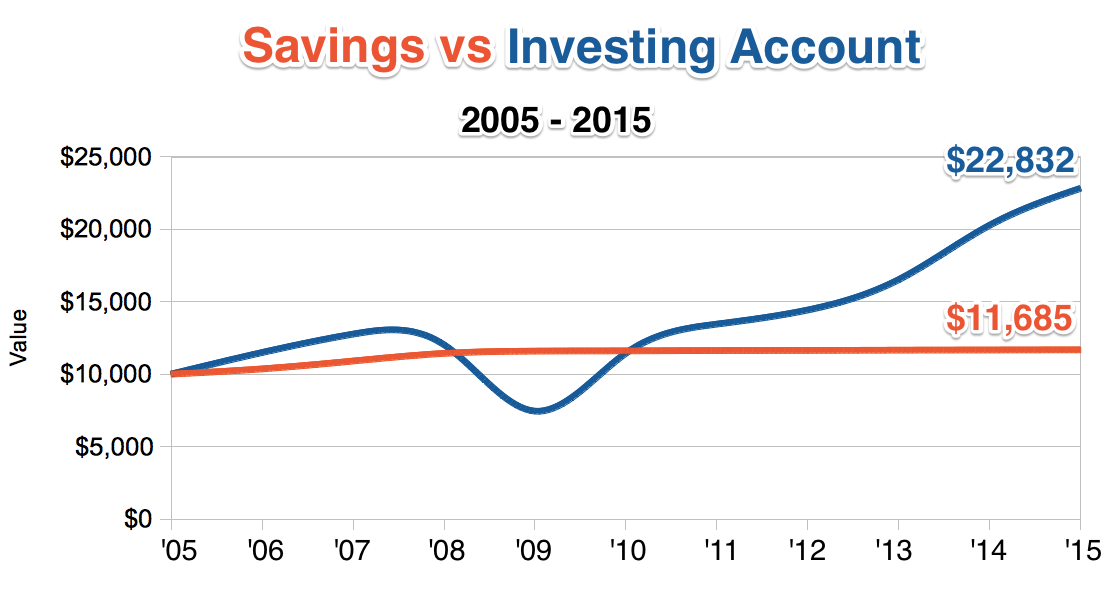

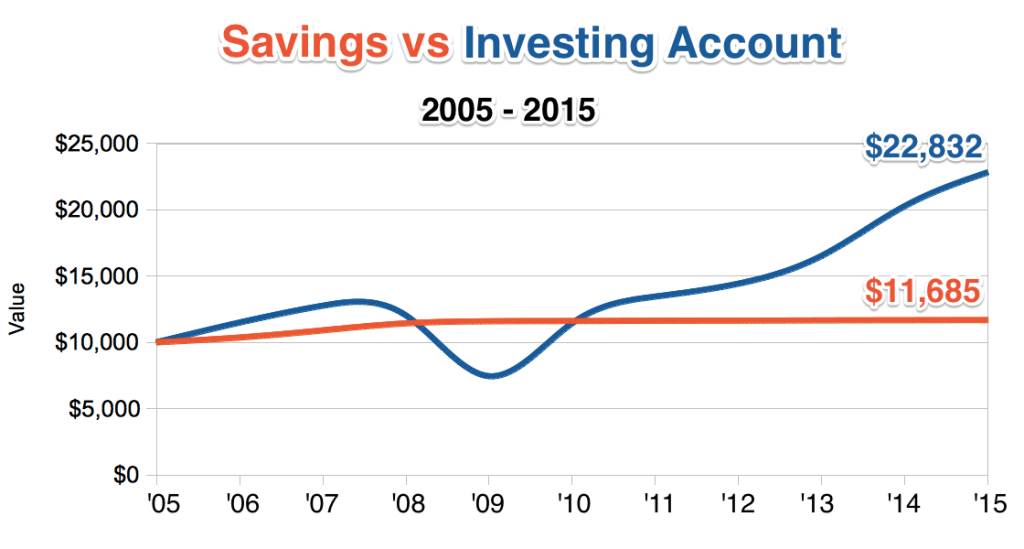

The easy way to beat 90% of professional investors is to invest that money in low cost index funds through ETF’s. That’s it. That’s all you need to know. It took me 10 years to learn this, but when I figured it out and back tested it, I laughed at how obvious and simple it is. Then I wondered why no one was teaching this. This should be taught in middle school and retaught in high school. So I vigorously scoured the internet and sure enough, tons of intelligent, respectable advisors and financial magazines tout the benefits of index investing and how professional fund managers don’t “beat the market”. And when professional investors say don’t “beat the market”, the market = index funds. It all seems so obvious, yet for some reason it’s not. So I’m here to bring the obvious to light. It’s index funds all day long, baby. Follow this advice and you’ll be earning money like those wealthy 1% who pay less tax than you. If you can’t beat ’em, invest in them!

The easy way to beat 90% of professional investors is to invest that money in low cost index funds through ETF’s. That’s it. That’s all you need to know. It took me 10 years to learn this, but when I figured it out and back tested it, I laughed at how obvious and simple it is. Then I wondered why no one was teaching this. This should be taught in middle school and retaught in high school. So I vigorously scoured the internet and sure enough, tons of intelligent, respectable advisors and financial magazines tout the benefits of index investing and how professional fund managers don’t “beat the market”. And when professional investors say don’t “beat the market”, the market = index funds. It all seems so obvious, yet for some reason it’s not. So I’m here to bring the obvious to light. It’s index funds all day long, baby. Follow this advice and you’ll be earning money like those wealthy 1% who pay less tax than you. If you can’t beat ’em, invest in them!

A common question from readers is, “Where should I put my money?” Whether it’s an inheritance, or money saved up over time, people new to having a relatively large sum of money often aren’t sure where to invest that money. Below is an example question from a woman in her 50’s and my response of where she should put her money for retirement and beyond. Though the answer can differ, here are the 4 best places that smart people put their extra money.

A common question from readers is, “Where should I put my money?” Whether it’s an inheritance, or money saved up over time, people new to having a relatively large sum of money often aren’t sure where to invest that money. Below is an example question from a woman in her 50’s and my response of where she should put her money for retirement and beyond. Though the answer can differ, here are the 4 best places that smart people put their extra money.