Looking for the easy way to make a budget? Here it is. Like most people, when you think of budgeting and organizing your finances, you think “ain’t nobody got time for that!”.

Well make time, my friend! You don’t want to live like Sweet Brown, do you? Ain’t nobody got time for that! Get yourself on a budget and you’ll be well on your way to getting rich. Here’s how.

1 – Earn Money

At the top of any budget is how much money you earn. We’re going to make a monthly budget because everything else is weird. If you get paid weekly, bi-weekly, or anything else, you’ll need to do a little math to estimate your monthly income.

Two easy ways to estimate your income.

3-Month Average: Take your last 3 months of paychecks and add them up. Take that total and divide by 3.

Example:

| When | Paycheck |

|---|---|

| 3 months ago | $3,000 |

| 2 months ago | $4,500 |

| last month | $3,000 |

| TOTAL | $10,500 |

| AVERAGE | $3,500 / month |

4-Week Salary: If you’re paid every 2 weeks, add your two paychecks together. If you’re paid weekly, add 4 paychecks together.

Example:

| When | Bi-weekly | Weekly |

|---|---|---|

| Week 1 | $875 | |

| Week 2 | $1,750 | $875 |

| Week 3 | $875 | |

| Week 4 | $1,750 | $875 |

| TOTAL | $3,500 | $3,500 |

As you can see, we’ll be working with a budget averaging $3,500 per month. There are a few ways to break this down. You’ll see how we handle months with extra paychecks. But first, we need to set our core budget.

2 – Core Budget

Your core budget includes your needs, not your wants. You don’t need a new car or an iPhone 6S. Those are wants. Don’t be confused. Your core needs are: food, clothes, shelter, electricity, and health insurance. This is your core. Without these, you’re starving to death, naked, homeless, freezing, or walking on thin ice (in order). Food = groceries. As Dave Ramsey likes to say “beans and rice, rice and beans”. Food does not equal eating out at restaurants or ordering pizza and take-out food every-other-day. Starbucks is also not food. The frappuccinos may contain enough calories to count as food, but that’s another story.

Typical American Monthly Food Budgets (2015)

| Who | Low-cost Plan | Moderate-cost Plan |

|---|---|---|

| Single Adult (19-50 yrs old) | $200/mo | $300/mo |

| Two Adults (male, female) | $500/mo | $620/mo |

| A Family (of 4) | $720/mo | $1,070/mo |

3 – Attack Debt like You’re Crazy

For your budget, list the minimum payments of all of your debts. Your mortgage comes first – because you need shelter. Your student loans are second because you can’t even bankruptcy yourself out of student loans! Your car payment, credit cards, and loans all come next. Make sure you list your minimum payments only. We’ll pay more later.

4 – Flexible Budget

Now it’s time for the part you were expecting – including all of the budget categories you like. You can break your budget down into any number of categories that make sense to you. Here’s a list of categories you might want to include:

- Restaurants (eating out)

- Cell phone

- Internet

- TV (cable)

- Clothes

- Hair & Beauty

- Car payment

- Gas/fuel

- Car Maintenance

- Entertainment (movies, etc)

- Gifts/Social events

- Christmas

- Alcohol (beer, liquor, wine)

- Coffee

- Books/Self-improvement

- Public Transport (taxi, bus, subway, etc)

- Household Goods (cleaning stuff)

- Toys/Kids

- Vacation/Day Trips

Be as broad or as detailed as you want. This is your budget, so you can make it fit your style. Some people prefer fewer categories for simplification. Other prefer to be more detailed to see more precisely where their money goes every month. The truth is: it will take 3 months of adjusting before you settle on a budget that works well. It’s okay to tweak and adjust as you go. Just remember your goals.

5 – Set Goals

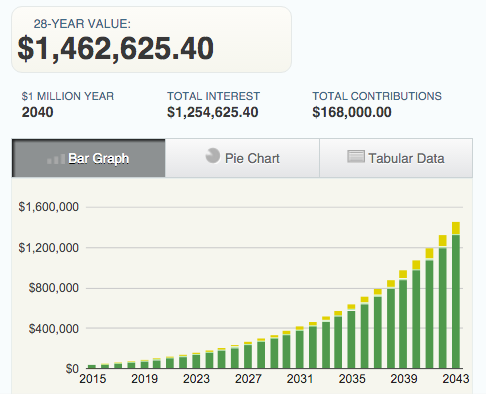

Don’t skip this step. It’s so important, it should be step 0, before “Earn Money” because your goals can affect how you earn money. What are you financial goals? Be a millionaire? Retire before you’re 60? Travel more? Me too. The only difference is that I’m already on the path to achieve these goals. At the time of this writing, with what I’ve saved for retirement, if I add nothing to it, I’ll have $1.5 million by the time I’m 70. I plan to continue contributing at least $500/month for the next 28 years, so I’ll have $1.46 million by the time I’m 60 years old. You too, can be well on your way to being a millionaire and retiring early if you get yourself on a smart budget.

Source: https://www.daveramsey.com/blog/investing-calculator/

Example Goals:

- Save $1 million for retirement

- Save $1,500 for Summer vacation

- Save a down payment on a house in 5 years ($40,000)

- Save $100,000 for kid’s college in 18 years

These goals might sound crazy impossible to someone just getting started on a budget. But once you get on a budget, you’ll be surprised how much “extra money” you’ll find. That extra money comes because with a budget you stop all the “extra spending” you don’t realize you’re doing.

So grab my Simplest Budget Spreadsheet and get started on your first budget. Once you open the spreadsheet go to File -> Make a copy… to save it for yourself. Then jump in and start editing it to your liking. If you have any questions, post them in the comments below.