Dave Ramsey is a genius when it comes to inspiring people with common sense to get out of debt and to live within their means. He gets a fair bit of criticism on his investing advice though. Dave recommends people spread their investments across four types of mutual funds:

- Growth (25%)

- Growth and Income (25%)

- Aggressive Growth (25%)

- International. (25%)

Enthusiastic readers and listeners probably run off to Google to find these 4 mutual fund investments to invest like Dave and build wealth. But the answers are hidden – and followers end up having to contact an investing ELP (endorsed local providers) SmartVestor Pro that follows Dave’s rules (and pays for his endorsement).

Dave purposely shies away from giving specific investment advice to his listeners. Part of it probably has to do with the rules and regulations around giving investment advice, and part of it is probably because he’s honed his message for simplicity and maximum effect. The problem is: many debt-free followers are left wondering where to invest their retirement or extra money. I’m no ELP SmartVestor Pro, but let me help fill-in where Dave has left off when it comes to investing in mutual funds for maximum efficiency.

4 Mutual Fund Types

Dave recommends investing equally among four mutual fund “types”:

- Growth and Income

- Growth

- Aggressive Growth

- International

The first problem is that it isn’t clear what these fund “types” mean. These aren’t exactly common terms used to describe mutual funds. So we have to interpret what Dave means. According to several others who have explored this topic and Dave’s own words, it’s fair to interpret his mutual fund recommendations as follows:

Interpreted:

- Growth and Income = Large-Cap Funds (which invest in big companies like Coca-Cola and Home Depot)

- Growth = Mid-Cap Funds

- Aggressive Growth = Small-Cap Growth Funds (which invest in smaller companies poised to grow bigger)

- International = World stocks funds (which invest in companies outside of the US)

Going backwards, international is the easiest one to interpret. Obviously Dave recommends investing in mutual funds that focus on companies outside of the US. The problem is that there are many types of international funds which only invest in China, or only Europe, or only “developing markets” like Southeast Asia or South America. How can you know which one to choose?

Next, Dave recommends Aggressive Growth, which means smaller companies. Small cap companies are considered aggressive growth because they invest most of their profits back into themselves in order to get larger (and more profitable). So, aggressive growth definitely means small cap companies, and we can find funds that invest specifically in small companies focused on growth.

Growth and Income means that the companies offer dividends or interest payments. These companies are usually larger companies that have grown large enough to offer value in the form of consistent profits (think Coca-cola and Home Depot). There’s not a lot of room for growth in these large companies. So growth and income means large cap.

The first category Dave always recommends is simply Growth which he calls the “Goldilocks” funds, because they’re “just right”. This category is considered the foundation of many diversified portfolio strategies. Dave explained on his radio show that this category means mid-cap funds. However, he also said that you could achieve the same “result” by investing in an S&P500 fund. He regularly mentions S&P500 funds as safe investments for people who have maxed out their retirement accounts and need to invest in regular taxable account. This “Goldilocks” category is where I personally invest most of my money. More specifically, I invest in index funds all day long.

Which Funds to Choose?

This is the golden question. Dave purposely makes a point not to recommend specific funds when he discusses investing. He emphasizes that investing in any mutual funds that even somewhat match his recommendation is a million times better than sitting out of the market. He relies on his ELP’s (endorsed local providers) SmartVestor Pros to handle the specifics. Well, I’m no pro, but I can look up mutual funds in an online screener and find the best performing over the last 10 years with average risk (or less). I specifically looked for funds led by the same manager for at least 5 years to fit Dave’s recommendation of fund with “long track records”. Here are 3 example portfolios loosely matching Dave Ramsey’s mutual fund recommendations:

| Category | #1 | #2 | #3 |

|---|---|---|---|

| Growth | PARWX | RBCGX | BOPIX |

| Growth & Income | JVAIX | JVASX | AUIIX |

| Aggressive Growth | BCSIX | PRNHX | LSSIX |

| International | FKSCX | OWSMX | ARTKX |

You can copy these ticker symbols and put them into your favorite search engine (Google Finance, Yahoo Finance, Morningstar, etc) to get more specific information. Or copy them down and ask your SmartVestor to find funds that match or beat these.

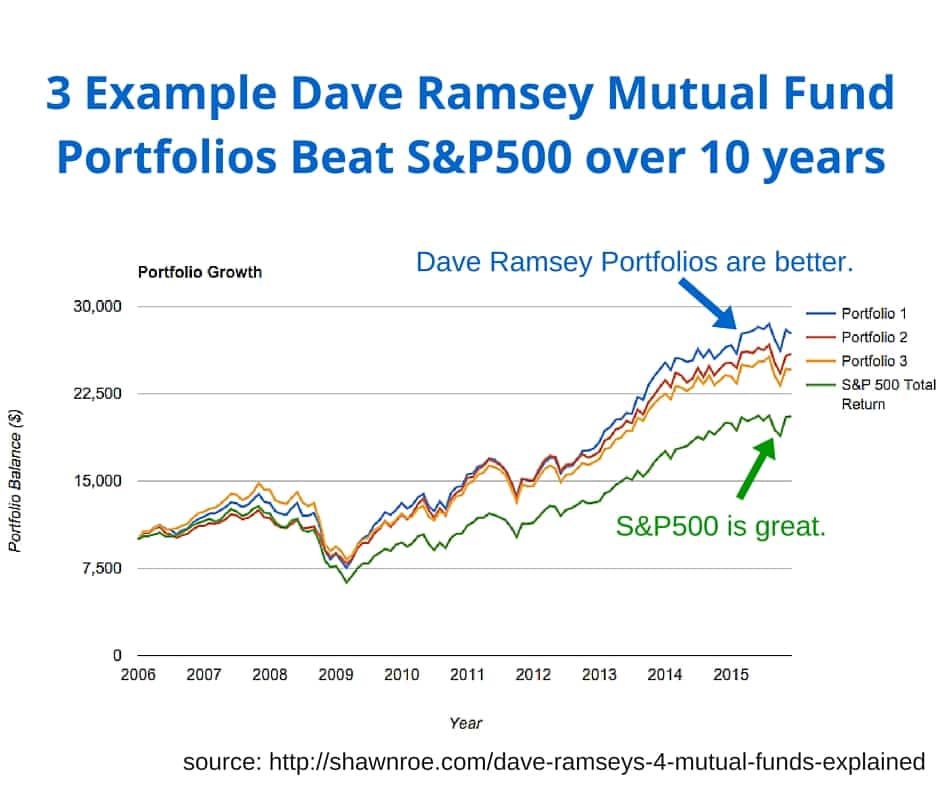

All 3 of the Dave Ramsey’s portfolios outperformed the S&P500 total return over 10 years from 2006 ~ 2016.

The S&P500 is the green line in the graph below. Notice how it’s lower than the other 3 lines representing Ramsey-like portfolios. The dates are from Jan 2006 to November 2015 or approximately the last 10 years.

But wait… there’s more!

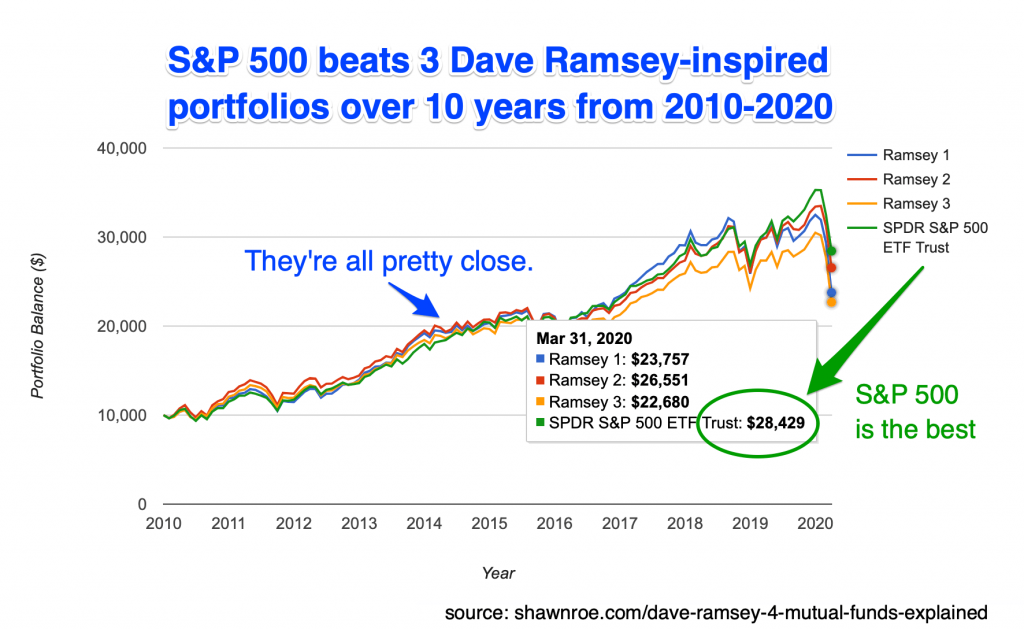

Hindsight is 20/20, meaning that it’s not fair to look back at historical returns and cherry-pick the best funds to match against the general market (S&P500). It’s been more than 4 years since I wrote the original article. Let’s see how the exact same mix of funds has compared over the last 10 years from 2010 to 2020.

Over the last 10 years from 2010 to 2020, three Dave Ramsey-inspired portfolios tracked pretty closely together until around 2018-2019. As of Mar 31, 2020, $10,000 invested in the S&P500 would’ve turned into $28,429. That’s almost triple, with not additional investments added to the original amount. AND it includes the beginning of the coronavirus crash of 2020. The original 3 portfolios that had beaten the S&P500, all lost more starting around 2019 than the S&P500 fund (represented by the ETF).

What should I invest in?

Some people give Dave Ramsey a hard time about his investing strategy being simple, or risky, or just plain wrong. The truth is that Dave’s best advice is helping people get out of debt. Once you’ve followed his plan to get out of debt, start looking elsewhere for investment advice. The easiest plan, which beats all other plans most of the time, is to simply invest in broad index funds with low expense ratios.

Disclaimer: I am not an investing professional. I’m also not affiliate with Dave Ramsey or any company he owns. The above is an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Interesting article, how do you compare this with your previous article that recommends index fund investing? Which method are you recommending for DIY Investors?

Highly recommend index investing – safer, more diversified, and more reliable.

My main issue with this analysis is that you can look at it in hindsight….but could you (or Dave Ramsey) have chosen funds that will beat the market 10 years ago, or choose funds that will beat the market for the next decade.

PARWX may have outperformed the market. But could you have picked it ahead of time? It also comes with a 0.95% expense ratio…..which over 10 years sucks away almost 10% of your returns…..compared to 0.05% for VTSAX.

I like index funds for the low cost and I’m pretty sure I’ll never venture into “Dave” style investing.

I agree with him on a lot of other issues….but his investing philosophy seems way off.

Spot on. You’re absolutely correct.

Mark, Ramsey recommends picking funds that already have a track record that exceeds the S&P rating. He recommends looking at funds with 5, 10, or 20 years of history and only choosing ones that consistently perform well. Nobody can predict the future with accuracy, but he definitely stacks his odds in his favor. Good luck!

This was exactly the explanation I was looking for as I entered that part of his book on investing.

Thank You!

Now, I think I’ll keep my VTSAX.

Shawn, this was a great analysis! I listen to Dave Ramsey’s podcast with some frequency, and I always find myself skeptical when he goes off about mutual funds. I think your analysis does a good job of demonstrating that one can beat the market with his investment strategy (though even the best 10-year funds couldn’t earn the 12% he always cites on his program). I agree with some of the other comments that the analysis above has the benefit of 20/20 hindsight. What I would be VERY fascinated to see is the same portfolio performance from 2005 to 2015, except using the funds that were highest rated and best performers AS OF January 2005. In other words, if we were just picking a “Dave Ramsey portfolio allocation” and we picked the best funds of each of the four asset classes as of January 2005 not knowing how they would perform from 2005 to 2015, how would the portfolio perform compared to the market? I wonder how difficult it would be to screen funds based on their ratings as of ten years ago?

Again, great job with this analysis!

Just thought I would throw this out there since I don’t think the mapping was spot on. In one of Dave’s books he defines the fund types as follows.

1. Growth and Income = Large Cap Funds

2. Growth = Mid Cap Funds

3. Aggressvie Growth = Small Cap Funds

Hi Shawn,

I stumbled onto your site and happened to read a previous article your wrote on Index funds. Are you still doing those? Do you do any stock picking at all? What is best way to contact you if I have a couple other questions? Thanks

Hi Diamond,

Yes, I am still mainly invested in index funds. I currently have a few leftover individual stocks that I invested in before I figured out that index investing was the best strategy. You won’t hear me recommending any individual stocks as safe investments. If you have more questions, you can email directly at shawn @ shawnroe.com.