If you’re a friend of mine and you don’t have a retirement account setup yet, I want you to open one today. Yes today. Right now. Hopefully you have $5,500 sitting in a savings account or CD earning you nothing right now. Why $5,500? Because that’s the maximum you can contribute to a ROTH IRA which is the retirement account you want to open (if you earn less than $183,000, which I’m pretty sure you do).

I’m going to help you put that money to work for you by opening an investment account with Axos Invest. There are tons of investing brokerages, but I’m going to highlight one of the easiest places to open an investing account today. You’re going to open it, answer some questions, send your savings there, and let it sit for a year. If you’re not happy with it after a year, you can take it back it and put it back where you have you now. But I’m confident you’ll be so happy with the result after a year, you’ll not only keep your money there but you’ll add more to it.

Before you get started, you’ll want to make sure you’re ready to invest. Lucky for you, I wrote an article titled, What to know before you DIY invest.

Step 1 – Skip the Line

Axos Invest is currently stemming the tide of new investments so that they can handle growth at a steady pace. Normally, if somebody signs up, you have to invite 5 people before you’re allowed to actually open an account. Lucky for you, I’m a founding member, developed a good relationship and got a special link that allows you to skip the line. Please don’t use this link lightly. Click the image below when you’re ready.

Enter your email address. Wait a couple minutes. Maybe get your savings account information while you wait. Check your email and click the link inside to get started.

Enter your email address. Wait a couple minutes. Maybe get your savings account information while you wait. Check your email and click the link inside to get started.

Step 2 – Answer the Questions

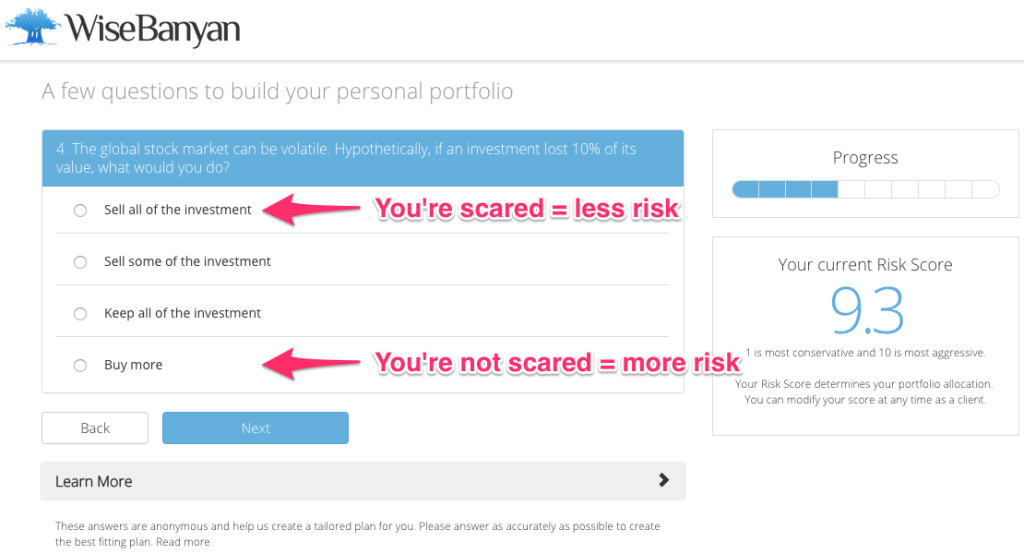

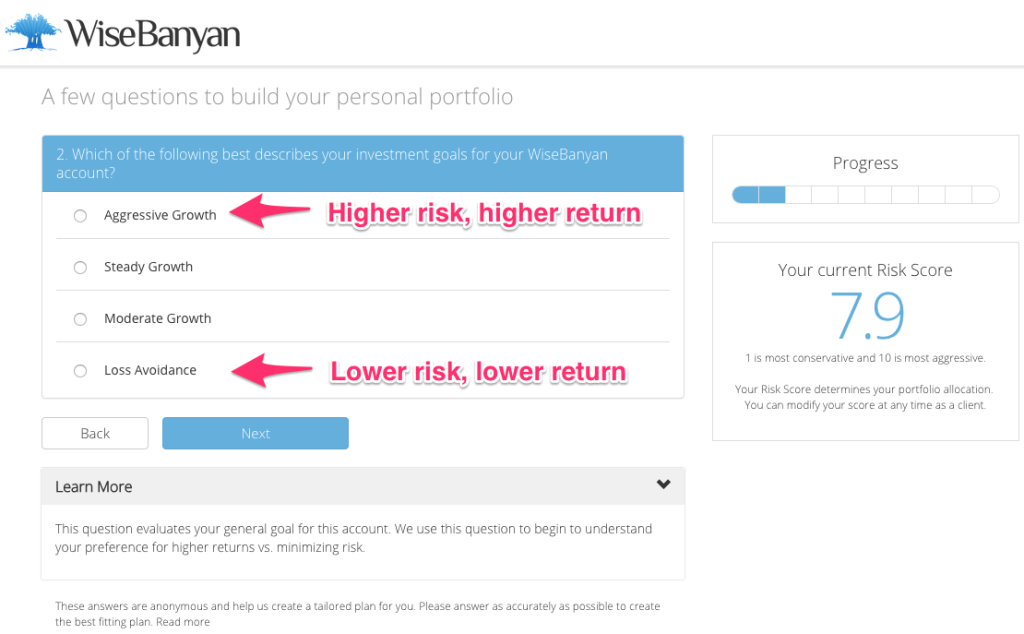

Axos Invest will ask you a series of questions like your age, your income, and some questions designed to estimate your risk tolerance. Don’t worry. There are no wrong answers. It’s all reversible at the end. Here are some screenshots to relieve your worries:

Obviously you can go through the questions and just answer whatever you feel to be true for you at the moment. Don’t worry about making the wrong choices. There is no failing in this questionnaire. You can manually adjust your ‘risk score’ at the end of the questionnaire and at anytime after you invest. All decisions are reversible.

There are hints in the screenshots to give you an idea of how the answer will affect your ‘risk score’. Just answer the questions until it gives you your ‘risk score’. Then come back here to understand what this score means so you can adjust to something you might like a little better.

There are a couple questions similar to this about what would you do if your investment lost or gained 10%. Basically, if you would sell, it means you’re risk averse and should have a lower risk score to invest in more stable investments with likely lower rates of return. But if you would buy more or hold, then you’re not scared of volatility when means you’ll feel okay investing in riskier investments that could offer a higher return (aka a higher risk score for you).

There are a couple questions similar to this about what would you do if your investment lost or gained 10%. Basically, if you would sell, it means you’re risk averse and should have a lower risk score to invest in more stable investments with likely lower rates of return. But if you would buy more or hold, then you’re not scared of volatility when means you’ll feel okay investing in riskier investments that could offer a higher return (aka a higher risk score for you).

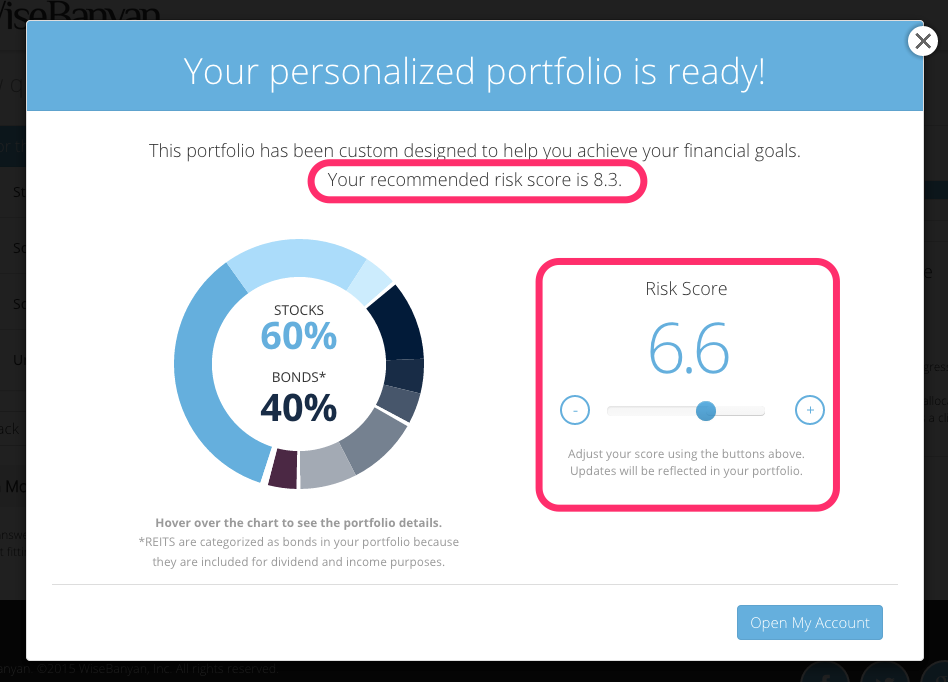

Below is the most important part. This is your recommended risk score showing you the portfolio asset allocation for that score.

Pause when you see this screen and read the information below.

Understanding your Risk Score and Asset Allocation

This is the golden part of Axos Invest and other robo-advisors. You can diversify and invest in a fantastically balanced portfolio amazingly easily. This is why you should invest your money here – because you’re too lazy to pick a diversified, balanced portfolio with low fees that will maximize your return and minimize your risk. And you’re smart enough not to over pay some advisor to hold your hand and do it for you. Let me explain a little so you can feel like you’re investing in the best way specific for you.

Rule of thumb: if you’re younger than 40 and don’t plan to use this money until you’re 55 or later (more than 15 years later), I would recommend selecting a higher ‘risk score’ because that extra time will allow you to weather the increased risk (and volatility) while most likely earning yourself higher returns. But if you’re getting closer to retirement, or you plan to use this money in less than 10 years (ie. as a down payment on a house), then you’ll want a lower ‘risk score’ to invest in more stable (less volatile) investments like bonds.

Stocks = higher risk and higher return

Bonds = lower risk and lower return

Naturally, you should invest a little more in stocks compared to bonds if you want to earn more money though with a little more risk. And if you’re worried about losing your money, don’t – invest more in bonds and you’re money is much safer, though you’ll earn a bit less over the long term (but that’s okay, because you really don’t want to lose any).

If you know the asset allocation you prefer, you can simply adjust the risk score to match that allocation. If you want 60% stocks and 40% bonds, just slide the score until it shows that breakdown. The highest risk score is 10 and that sets the allocation to 91% stocks and 9% bonds. (That’s where I have it set for my portfolio – I’m 31 and don’t plan to use this money for at least 15 years.)

Shawn’s Advice (higher returns with a little more risk)

The old rule of thumb is to hold your age in bonds. That means if you’re 30 to hold 30% of your portfolio in bonds and 70% in stocks. This rule has been modified in recent years as people are living longer. You need to invest a little more aggressively to meet the needs of a longer retirement. The new rule is your age minus 20 in bonds. So a 30 year old would invest 10% in bonds and 90% in stocks. I subscribe to this modern rule of thumb. I’m also young, healthy, not afraid of risk and hope to retire earlier than average.

Investing for Retirement (Age – 20 in bonds)

| Age | Stocks | Bonds |

|---|---|---|

| 30 | 90% | 10% |

| 35 | 85% | 15% |

| 40 | 80% | 20% |

| 45 | 75% | 25% |

| 50 | 70% | 30% |

| 55 (retire at 70) | 65% | 35% |

Investing for Retirement (Age in bonds)

| Age | Stocks | Bonds |

|---|---|---|

| 30 | 70% | 30% |

| 35 | 65% | 35% |

| 40 | 60% | 40% |

| 45 | 55% | 45% |

| 50 | 50% | 50% |

| 55 (retire at 70) | 45% | 55% |

Consider your specific situation and adjust accordingly. The most important thing is that you save, invest, and diversify. Axos Invest is allowing you to do this easily (and for free).

Step 3 – Fund the account

Time to commit. Link the bank account you wish to transfer to and from Axos Invest. It can be your savings account where you’re holding your money now, but I’d recommend connecting your main checking account. Transfer your savings to your checking and then that money to Axos Invest from your main checking account. This way you can transfer in and out to your main account.

You can choose to do a one-time deposit (like me) or set up an auto-deposit weekly, monthly, or quarterly. If you can handle auto-deposit, studies have shown it’s the best way to ensure you’ll have money in your retirement. But if not, send what you have and within 4-5 days, your money will automatically be divided up and invested in a properly diversified portfolio like a real investing pro. And all you did was answer a few questions and click a few buttons.

Ready? Go to Axos Invest now and sign up for an account.

If you have any questions or comments, leave them below.

Nice article, Shawn. I just had a question. In your “Tony Robbins Stronghold Financial Review–Caution” post, you mentioned opening up a brokerage account like TD Ameritrade. In this post, you suggested linking a personal checking or savings account to a Axos Invest account. So, if I opened up a Axos Invest account would this be in addition to my TD Ameritrade account or would it be replacing it? I assume it’s the former, but I just wanted to be sure. Thanks!

Good question Joe. So you have to understand the difference between a broker like TD Ameritrade and a robo-advisor service like Axos Invest. Essentially you can choose any stock, ETF, bond, mutual fund, and more through a brokerage like TD, E-trade, Scottrade, etc. They usually charge you a transaction fee each time you buy or sell.

A robo-advisor, like Axos Invest, Betterment, or Wealthfront, limits what you can own to usually less than 20 low-cost ETF’s. They will divide up your portfolio according to your ‘risk score’ or something similar and only charge you a monthly fee (or no fee in the case of Axos Invest).

So, it’s up to you whether you only use one service or use both. Both has it’s advantages and disadvantages. That’s the simplest explanation.

Can I link my TD Ameritrade account with Axos Invest like you tried doing with SH? In the Tony Robbins article? What are the advantages and disadvantages of running both? Thanks!

You can link one bank account with your Axos Invest account. This account will allow you to transfer between the two accounts. Whichever account you want to use to transfer money to/from Axos Invest is the account you should link. Axos Invest does not analyze your investments like SH purports to do.

As for advantages and disadvantages – that’s a good question. I should write an entire post on that subject.

Hey Shawn, stumbled into your blog and just wanted to start off by thanking you for putting in the time to write this. I’m 26, and your chart has a year 30 starting point. I am just dipping my toes into investing, and I’m a bit nervous just handing my account info over. Aside from the fees, what makes WB a better choice than SH? What are your thoughts about investing at this age?

Hey Brian, glad you like the site. As for starting to invest – the younger the better. Google “compound interest” and devour the magic of that math.

The first caveat would be debt – get out of debt before you start seriously investing. Any debt you pay off is a guaranteed return on your money of that debt’s interest rate. Debt = slavery. Don’t be a slave.

The second caveat would be that an investment in yourself is the best investment you can make. Graduate from college, upgrade your skills, and get better at whatever you’re good at. I put aside $100/month in a self-improvement fund so when I stumble across a course, a workshop, a book, or anything else that I think will upgrade my skills, I don’t hesitate at the cost. I can usually pull the trigger pretty easily because I have money set aside specifically for “improvement”.

Lastly, what are your goals? Do you plan to own a house, get married, get an MA, or MBA, or travel? You might want to set aside some money for your near-term goals as well. I’ve been fortunate enough to see more of the world than I ever imagined I would and the perspectives I’ve gained have changed my life forever.

Fear comes from not knowing or not understanding well. That’s okay. Take your time and get to know (1) what you want, and (2) what it will take to get there. That means start reading more about investing until you feel comfortable enough to get started. I started with $500 when I was 18 years old. I learned a ton, and yes, much of what I learned came through investing mistakes. But that’s okay. Now I know. I feel more comfortable. And I know my goals. And I’m much more confident in my saving, spending and investing strategy.

Sorry this might’ve been longer than you expected. It’s hard to give more specific advice when I don’t have more specifics to go on. Shoot me an email if you want. Happy to help any way that I can.

Would love to get in touch, couldn’t find an email though. (probably right in front of me)

Shawn, thanks for your info. here. I am in my ’50’s and have investments with Vanguard. One is an Index fund for sure…but you are talking about this Axos Invest and I wonder if there is a way to transfer investments from Vanguard to there? Also, I have an old Annuity…Vanguard apparently has ETF’s. Would there be an advantage to converting what I have there already into ETF’s? Sorry, I am obviously not well educated in all of this. I did read some of Tony Robbin’s book and visited Stronghold, etc. But I didn’t trust what was going on there at the time. Thanks!

Hi Carol, if you already have investments at Vanguard, you don’t need to transfer anything over to Axos Invest. Vanguard offers great, low-cost, investment options. Axos Invest actually uses many Vanguard ETF’s to allocate their portfolios. 🙂

Carol – it sounds like you’re not sure exactly where your money is and what it’s doing for you. Being in your 50’s, you can probably sense retirement is not far away, and you’re unsure if you’re prepared. Am I right? You want to be excited about retirement, but it’s hard to be excited because you’re not sure if you’ll have enough money, right? It’s time for you to get a better grasp on your finances. I want to help you, if you’d like my help. My email address is my first name @ my full name .com (If I type the whole email out, evil computer robots will spam me. I hope you understand.)

Shoot me an email and I’ll see if I can’t help you feel a bit more comfortable about your finances. The good news is that it sounds like you’re on the right track so far.

Shawn, thanks for the help. I really do appreciate what you and Tony do to help others with the knowledge you have learned. Thats right I’m putting you and Tony in the same category! You even more, because I am following your advice using that link to Wisebanyan and not SH.

But, before I click that link…do I still need to find a fiduciary advisor? I’m sorry if that is a stupid question, but this is my attempt at investing in the market and I am a little confused, am I using wisebanyan for all my stocks and bonds? Am I putting money away each month into this wisebanyan account? I also want to take advantage of my business and invest through it to help soften the taxes. I thought I would need an advisor to help guide me in that area. Will wisebanyan do that for me?

Also, I am 33 with over $10k in a savings account, apparently losing money. As you mentioned before $5500 is the max for a Roth IRA.

Sorry if I’m all over the place, I am excited to invest and make more money with my savings!

Stay Stoked!

Hey Morgan. I’m honored that you would put Tony and me in the same category. I’m glad to help any way that I can. If you’d like to start a dialogue, shoot me an email at my first name [at] my website address. It would be helpful to have more information about your specific situation before I suggest any specific advice. Be stoked! When your money is working for you, it can be pretty exciting.

Thanks for this blog; it’s so helpful! Regarding Wisebanyan, one recent reviewer asserted that the zero fee model is unproven, and that its future is uncertain. Would that be a reason to chose Wealthfront or such?