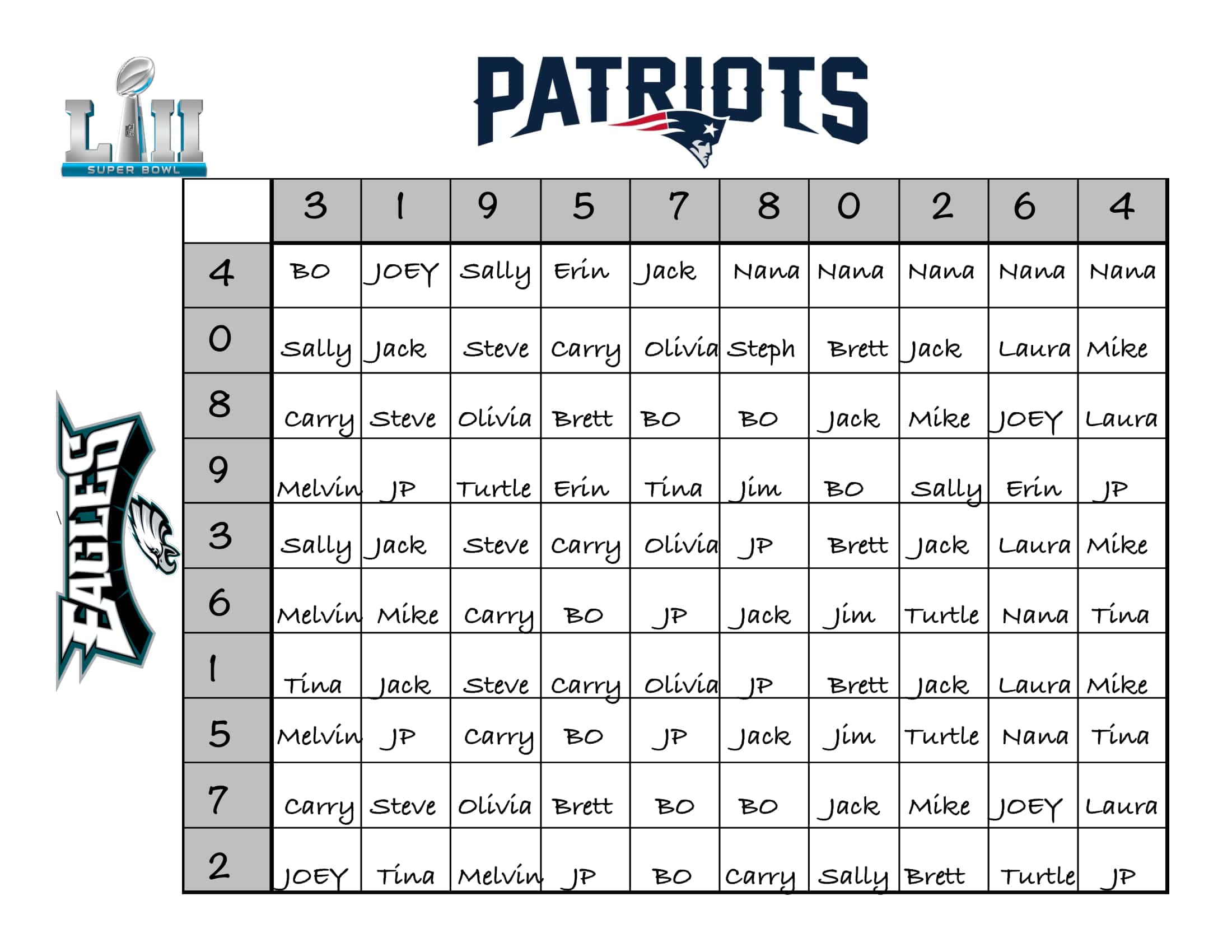

Super Bowl Betting Squares is a fun (mostly random) betting game for your Super Bowl party. If you’re hosting friends and family to watch the Super Bowl this year, you’ll want to include this game as part of your fun. Everyone, from kids to grandparents, and even non-football fans can enjoy the game when they participate in a Super Bowl Betting Squares game.

It may take a bit of convincing at first. But the people who toss $5-$20 into this fun Super Bowl betting game will be happy they did. And your hardcore sports betting friends won’t have an advantage. This isn’t an over-under bet. You’re not choosing sides. It’s pure, random fun.

How Super Bowl Betting Squares Work

All the money put in the pot will be distributed by the end of the game. So if you’re doing $1 per square, then all $100 that goes in will end up in participants’ pockets. This means Grandma might win $15, and niece Lily could be the big winner with $35. Big John might walk away with $5, and most people likely will win nothing.

But when you see your friend who doesn’t care about football rooting for a Chiefs field-goal in the 3rd quarter because it means they’ll win $5, you’ll know you’ve just upped your Super Bowl Party level to the next level. Here’s how to create a fun 10×10 square Super Bowl betting squares chart that’s fun for everyone who plays.

Materials

- Poster board

- Magic marker (black, permanent)

- Deck of cards (or random numbers 0-9)

- Basket, hat, or bowl (for the money)

Set-up

- Draw lines dividing the poster board into 11 x 11 squares (draw 10 lines horizontal, and 10 vertical).

- Pro-tip: Leave a little space on the top and left edge to write the team names.

- Write the team names. On the top edge write one Team Name (49ers), and on the left edge write the other Team Name (Chiefs)

- Have people buy squares for $1 each.

- The total pot will be $100 if you fill up the board. Participants aren’t betting on any team to win or any specific score. You’re essentially just buying a “ticket” to play (each square = a “ticket”).

- Pro-tip: Try really hard to fill-up the board. Buy all the empty squares leftover for yourself if you have to.

- Note: If you don’t fill up the board, it’s okay. If an empty square wins, then nobody gets paid. Everyone will be disappointed and maybe they’ll buy more squares next year!

- People write their names in any of the inner 10×10 squares (it’s random). Just write your name in any square. $1/square.

- Pro-tip: Fill the squares before kick-off. If people will arrive after kick-off, call them beforehand. Have them commit $5 or $10 to squares and you can write their names in for them beforehand. Remember, it’s random anyway, so there’s no disadvantage. They could still end up big winners!

- Add the numbers to the top row and left column.

- IMPORTANT: the numbers are filled in AFTER all the names are written in the squares. This keeps it random, and allows everyone to have an equal, random chance of winning. Use the deck of cards to draw random numbers for each square in the top row and left column. Fill them in with numbers 0-9 (yes, include 0). Don’t do it in order. Make it random!

Have you ever had an unexpected bill set you back and make you go deeper into debt? Those new tires set you back $400. That trip to the doc cost $800! Or that time your electric bill doubled in one month! It happens to all of us. So, what’s the best way to deal with an unexpected expense? A buffer month of money has prevented me from going into debt, and it could help you too.

Have you ever had an unexpected bill set you back and make you go deeper into debt? Those new tires set you back $400. That trip to the doc cost $800! Or that time your electric bill doubled in one month! It happens to all of us. So, what’s the best way to deal with an unexpected expense? A buffer month of money has prevented me from going into debt, and it could help you too.