A common question from readers is, “Where should I put my money?” Whether it’s an inheritance, or money saved up over time, people new to having a relatively large sum of money often aren’t sure where to invest that money. Below is an example question from a woman in her 50’s and my response of where she should put her money for retirement and beyond. Though the answer can differ, here are the 4 best places that smart people put their extra money.

A common question from readers is, “Where should I put my money?” Whether it’s an inheritance, or money saved up over time, people new to having a relatively large sum of money often aren’t sure where to invest that money. Below is an example question from a woman in her 50’s and my response of where she should put her money for retirement and beyond. Though the answer can differ, here are the 4 best places that smart people put their extra money.

Shawn,I won’t go into details here, but I moved my 401K to Stronghold last December and it was a nightmare. I too read Tony’s book and was fired up to do something and that’s what I did. Thankfully, the operation manager at SH cleaned up the mess, but since then I’ve left things alone for the most part.(Can I just say here that this [investing] stuff terrifies me?)I just received an estate inheritance, taxes have been paid and I need to invest it now. It’s been sitting in my Money Management account with my credit union, but that’s not wise for much longer. I’ve contributed what I can into my IRA for 2015, same for my HSA, and my plan was to put the rest into my SH investment account. I just read your posts and am thinking that Axos Invest may be a better bet. Given my age [in my 50’s], the 45% Stock/ 55% Bond mix makes sense. Also given the difficulty of interactions with Stronghold, I’d like this process to be easier.Should I put the money into Axos Invest?Your thoughts on next steps would be greatly appreciated.VERY grateful to have come across your blog, in any event, thank you very much Shawn! Sounds like you’ve crafted a lovely life for yourself!Wishing you continued happiness and success.Sincerely,R

Hello R,

Thanks for the compliments. Glad you’ve found my site helpful.

Step 1: Be Debt-Free

First off, I’m assuming you’re out of debt. All of your credit cards are paid off monthly (or have $0 balances). You have no outstanding loans or lines of credit for anything. And you own your house – aka, you have no mortgage payment. Those would be the first places I would put your inheritance money.

Step 2: Emergency Fund of 3-6 Months Expenses

Secondly, I’m a believer in having an Emergency Fund (EF). You should have a simple savings account (or money market account) with 3-6 months of expenses saved. This is strictly for emergencies and hopefully will never be touched. The point of an EF is to protect you in case something financially unexpected happens. Your credit union is a great place to keep this EF. And don’t worry about it earning little to no interest. That’s not the point. Many people have between $10,000-20,000 in an EF. Six months worth of expenses (not income) saved.

Secondly, I’m a believer in having an Emergency Fund (EF). You should have a simple savings account (or money market account) with 3-6 months of expenses saved. This is strictly for emergencies and hopefully will never be touched. The point of an EF is to protect you in case something financially unexpected happens. Your credit union is a great place to keep this EF. And don’t worry about it earning little to no interest. That’s not the point. Many people have between $10,000-20,000 in an EF. Six months worth of expenses (not income) saved.So, assuming you’re completely debt free, and have an EF, let’s talk about retirement and investing the easy (and best) way.

Step 3: Retirement Investing

There’s a simple hierarchy of retirement accounts that offer the greatest benefit.

- Matching 401k – invest up to the match

- Roth IRA – maxed out at $5,500 (or $6,500 if you’re age 50 or older)

- Traditional IRA – if you earn more than $183,000/yr single or $193,000 married

- 401k – up to $18,000/year

The goal is to invest around 15% of your take-home pay into retirement accounts. So if you earn $65,000/yr, and take home about $4,000/month, you’d want to put $600/month or $7,200/year away for retirement. You’d just roll down the hierarchy. If your company matches 3% of your salary, you’d put $1,950 into company 401k to get the match. That’s a 100% return on your money! Then you’d put the rest ($5,250 = $7,200 – $1,950) into a Roth IRA assuming you’re eligible. A Roth IRA allows your earnings to grow tax-free, which is amazing over the long-term. If you’re not eligible, then you’d put your money in a Traditional IRA.

Now that we have your retirement money divided up. All of it should be invested in the market and diversified. The easiest way to diversify (aka protect your money) is to invest in mutual funds. There’s a type of mutual fund that simplifies things by just following an index (like the S&P500). These index funds don’t really need managers because computers can follow the indexes pretty easily. Therefore, index funds often end up having lower fees compared to actively managed mutual funds. Lower fees means more of your money stays your money (to grow for you). I’m a believer in index funds.

Step 4: Build Wealth to hit your Goals

Okay, so where do you put all the leftover money? It depends on how you plan to use the leftover money (ie. your goals). If you plan to go on a nice vacation, budget out the cost and put enough money in a simple savings account (or even your checking account). For very short time frames (2 years or less), there’s no need to invest.

| Goal | Timeframe | Where to put money |

|---|---|---|

| Vacation to Asia | 1-2 years | Savings, or checking |

| Down payment on House | 3-7 years | CD, Money Market, savings |

| Retire and live off it soon | 7-10 years | Balanced fund including bonds (60/40, or 50/50) |

| Retire and live off it later | 10 years + | Index funds (100%) |

If you plan to use the money or earnings from the money as living expenses in retirement within the next 10 years, then you would want to invest the money in a more balanced way. This means investing in stock index funds, and bonds (or bond index funds). Bonds have an extremely low return right now because the Fed Reserve interest rate is so low. This is bad for your money earning more money. But it is good for stability. You can feel safer that your money won’t go down in value and if you need the money, you don’t want it to go down. So, something like a 60/40 or 50/50 split would be relatively safe for your money.

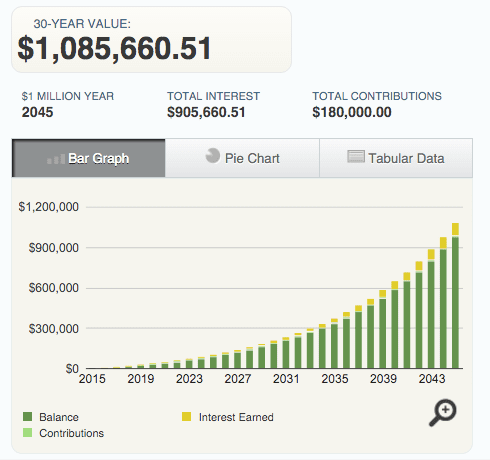

However, if you won’t need your money for more than 10 years, investing in stock index funds offers you the best possible chance for the highest returns. (Read more about the benefits of index investing) Because your timeframe is longer than 10 years, you will have time to wait out any temporary downturns in the economy (or markets). For example, if you had invested $100,000 in the US market in 2005, 4 years later in the lowest point of 2009, you would’ve lost 40% of your money! Oh no!! But if you had a timeframe of 10 years and just waited out the downturn, 10 years later, by 2015 (now), you would have earned 71% on your money! Yay! That’s a fantastic return over 10 years, considering it includes one of the worst market downturns in history. A Bond fund, by contrast, would’ve returned maybe 6% over the 10 years! Yes, that’s a huge difference ($70,000 extra from stocks vs $6,000 from bonds in our example).

Which Company is the Easiest?

As for Axos Invest vs any other place. Axos Invest is one of the easiest ways to invest your money in a balanced way. WB takes care of your money for you, safely, without you having to worry about rebalancing. You set your risk tolerance, which determines your stock/bond split to whatever fits your comfort, and WB keeps your portfolio balanced for you… for free (read a detailed explanation of opening an account at Axos Invest). I’ve communicated with WB a few times, and each time received very friendly help. They’ve refunded credits I accidentally used with no complaints. So far, I’ve been happy with their support and communication. That being said, they don’t act as personal (1-to-1) financial advisors. The platform is the advisor.

Vanguard can do a similar thing through their Target Funds. Simply choose your age range, and put your money in that fund. The fund will adjust to a safer (less volatile) allocation as you get closer to retirement and you can be confident that you’re maximizing return and minimizing risk which should be any investor’s goal.

Great info I saw WB on Facebook but after reading the comments I was kind of turned off of it. Now after reading your article and looking the site over thoroughly I am definitely sold. Also reading Money Master The Game by Tony Robbinson and because I don’t have a lot of knowledge in the investment game it has opened my eyes a helped me get the ball rolling on actually saving outside of my work 401k but also realize after finding your site its good to learn as much from people who are actually putting these techniques in play.