So, I wrote a quick review of Tony Robbins’ recommended Stronghold Financial portfolio checkup software in the early stages of it’s release. My initial review was for the common investor to take caution. It was a simple ploy to get a lot of people to signup for their investment advisor services through Tony Robbins’ genius marketing skills. Now, 8 months later, I’ve decided to give the service a second chance. Here is my updated review of Stronghold Financial’s portfolio checkup software.

One Giant Sales Landing Page

If you go to the Stronghold Financial homepage, of which I am purposely choosing not to link to, you will be presented with one giant sales landing page. It’s much better constructed compared to the original version. The first thing to pop up is a quick explainer video by Ajay Gupta. I’m kind of surprised they couldn’t get Tony to do the explainer video. It arguably would’ve been 15x more effective (Tony’s trust factor is so damn high). Alas, you get boring Ajay in front of a bunch of framed certificates (how many colleges did you graduate from, man?) telling you to sign up and trust the advisors he’s hand-picked to make your investing decisions for you.

Honestly, I only watched a little over half of the video before I clicked out of it. Unfortunately the sound continued playing in the background while I browsed the rest of the landing page, I mean “site”.

All the links lead to one place – like any good sales page – funneling visitors down the money-making path. Emphasizing that it only takes 3 minutes and that signing up is free, the sales page just wants you to use the “free” tool so you can see in a beautiful graph form how the “example portfolio” they recommend will earn you more money and cost you less in fees.

Offering Lower Returns

After entering my age, income, and expected retirement age, I connected my Roth IRA investing account with the portfolio analyzer. After gathering my investment details, the app worked it’s magic. Here’s what I saw:

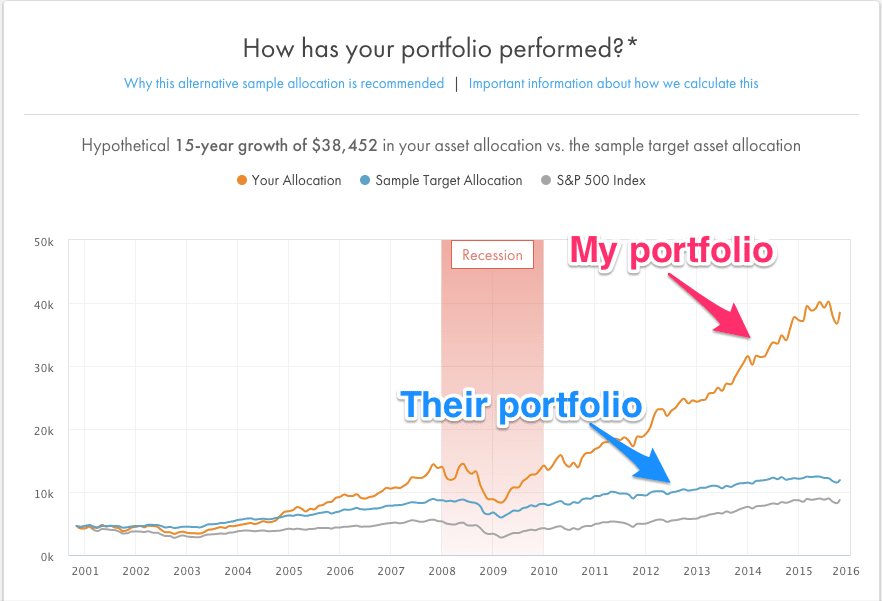

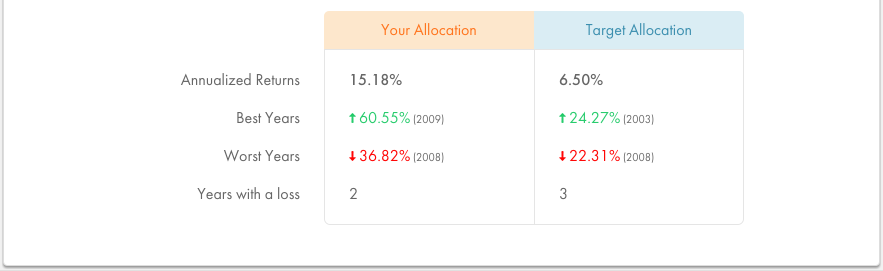

Wait. Look carefully. The orange line is supposed to be what they will do for me, and the blue or gray line is how poorly I’ve performed. But that’s not the case. The orange line is my allocation. Over the last 15 years, I’ve killed their “sample target allocation”. Ha ha. Sales pitch fail.

This is real data. This is actually what they showed me. The numbers aren’t exactly clear, but it appears that a little less than $5,000 invested with them 15 years ago would be around $12,000 today. But had I invested on my own (as I did), that same $5,000 would be (is) almost $40,000 today. So, I’m supposed to give up my 5x better returns and invest with them? Ha ha. Nice try. I even chose their most aggressive risk option giving them the best chance of high returns (as opposed to any of the moderate or more conservative options). As you can see, my allocation returned more than 15% annualized compared to their 6.5%. I even had fewer years with a loss. This is real data. I simply linked my retirement account from TD Ameritrade with my actual investments.

With Higher Fees?

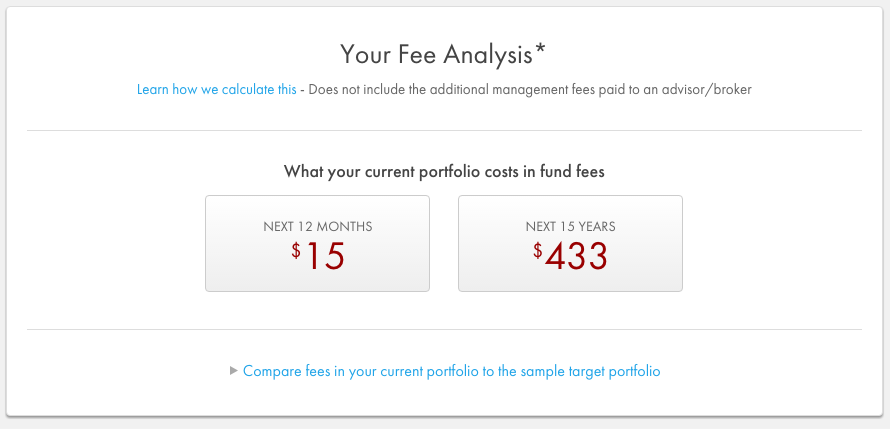

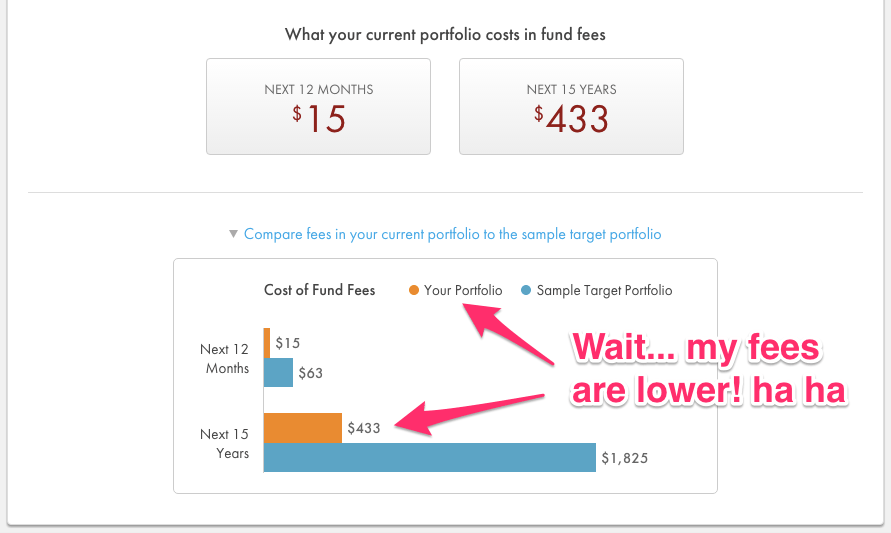

Well, maybe there’s another benefit of them. Maybe they offer lower risk and lower fees. Let me see. Below the charts boosting my ego on my investment skills are big dark red numbers showing me the fees I’ll pay in the next 12 months and the next 15 years! Okay, here’s where they’ll taut their benefit. I get great returns, but do I get them at a higher cost? I don’t see the comparison to their fees. Look a little closer, and there’s a link to click.

I click the link that says “Compare fees in your current portfolio to the sample target portfolio”. Here’s what I see:

Wow. They are failing at this sales pitch all over the place. I don’t mean to sound like I’m bragging, but Stronghold Financial has just proven once again that they are not a good deal (for me, at least). I wasn’t impressed when I first signed up, and 8 months later, this second chance is proving that I’m better off without them.

Conclusion

You can do this. You can invest on your own. You don’t need Ajay Gupta’s Stronghold Financial, and you don’t need to pay any of the recommended advisors to invest for you. But, you’re lazy, right? You don’t have time. You have money and no time. You’d just rather pay somebody to do it for you and not have to worry about it. Fine. Eight months later, I still recommend you try a robo-advisor like Axos Invest. Why Axos Invest over any of the others like Betterment, WealthFront? Because Axos Invest is free. That’s right. The others are low cost and not a bad deal, for sure. But it’s hard to beat free especially when Axos Invest is doing the same style of investing (and management) as the others.

What if you want to learn how to invest on your own like this guy, Shawn Roe, who seems to be doing alright? Keep reading my friend. I’m no professional, but I’m a teacher at heart (and by trade), so I’d be happy to hold your hand and walk you through this empowering world of investing for retirement and wealth. Start here: