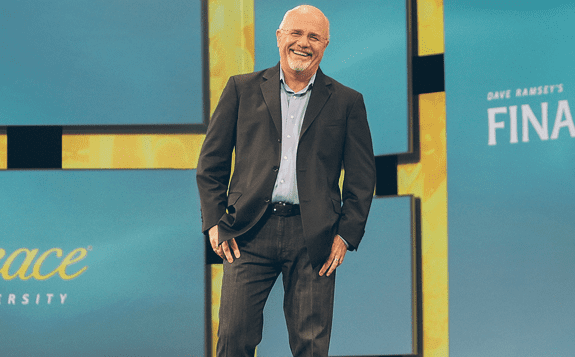

Dave Ramsey is a genius when it comes to inspiring people with common sense to get out of debt and to live within their means. He gets a fair bit of criticism on his investing advice though. Dave recommends people spread their investments across four types of mutual funds:

- Growth (25%)

- Growth and Income (25%)

- Aggressive Growth (25%)

- International. (25%)

Enthusiastic readers and listeners probably run off to Google to find these 4 mutual fund investments to invest like Dave and build wealth. But the answers are hidden – and followers end up having to contact an investing ELP (endorsed local providers) SmartVestor Pro that follows Dave’s rules (and pays for his endorsement).

Dave purposely shies away from giving specific investment advice to his listeners. Part of it probably has to do with the rules and regulations around giving investment advice, and part of it is probably because he’s honed his message for simplicity and maximum effect. The problem is: many debt-free followers are left wondering where to invest their retirement or extra money. I’m no ELP SmartVestor Pro, but let me help fill-in where Dave has left off when it comes to investing in mutual funds for maximum efficiency.