This is a review for the new tool endorsed by Tony Robbins by Stronghold Financial that apparently gathers your investment portfolio details and compares them to an asset allocation laid out by the investment firm, Stronghold Financial Group. (Update: It’s now called Portfolio Checkup by Creative Planning. I guess negative reviews forced them to rebrand?)

Like many others in my generation (young 30’s), I found out about Stronghold Financial from listening to a Tim Ferriss interview with Tony Robbins (listen here on iTunes, or on Tim’s site here) . Tony Robbins is a ridiculously inspiring human and listening to him speak about anything will light a fire under your tail and make you want to live a better life and be a better person.

Since I don’t have access to any cryogenic machines (if you listened to the interview, you’ll understand), I decided to test out this investment tool that Tony purports he convinced these super-smart financial guys to create for “the average man that really needs it”. I’m going to review this financial investment tool from Stronghold Financial.

Stronghold Financial Review

First, I navigated to the website www.StrongholdFinancial.com and I know I have the correct page because I immediately see good ‘ol Tony Robbin’s face smiling at me. The second things I notice is the following disclaimer that Tony doesn’t get any money either directly or indirectly from Stronghold:

“Tony Robbins is NOT an owner of Stronghold nor does he receive any direct or indirect compensation from Stronghold.”

I’m a bit skeptical, but I decided to try it out.

So, I click on the “Get Started” button and am prompted to sign up. I put in my email address and create a password. Easy enough so far.

Then it asks a series of questions like my age, my annual income, my gender and my risk appetite. I’ve answered all these questions before on simple investing calculators so it’s not a problem.

Then comes the important part – the patented technology part. And this where I run into the first major problem. I’m asked to link my investing account to their website. Anyone in their right mind should hesitate before entering their login credentials (including their password) for any account of any value, particularly any bank account.

After a bit of due diligence on the security of imputing said information, I decide it’s safe enough (scold me now, because ultimately I probably shouldn’t have). My account is through TD Ameritrade and I sync it up. Or so I thought.

Error linking account

Stronghold Financial returned an error message after authenticating my investment account. This it not good. A) because if I can’t link my actual investing account, their tool is useless and B) if this first step returns an error, I’m much less confident of my data being safe. Were my login credentials hacked as they were sent over the servers? Did they make it to Stronghold’s servers safely and now they’re in a SQL database somewhere just waiting to be hacked? Or, best case scenario: did TD Ameritrade prevent this “suspicious” activity and block the connection? The problem is, I don’t know.

“We were unable to update your account. Please try again later and if it still does not work please contact support. {CE 311}”

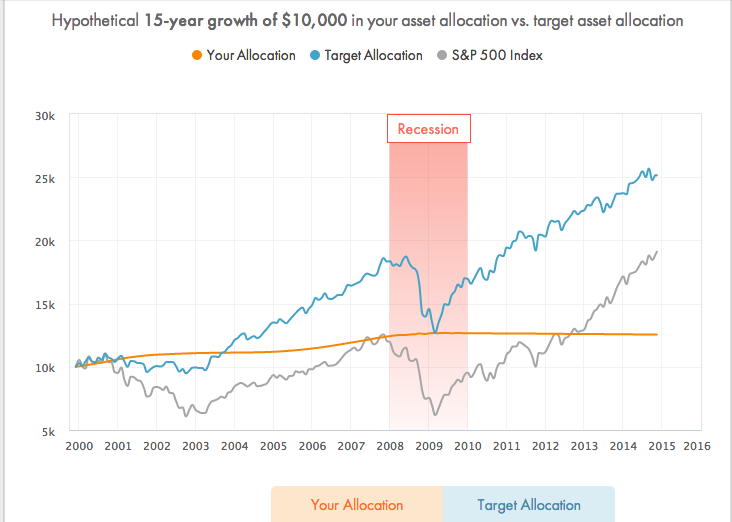

So, now that I’ve inputted pretty sensitive information and received an error, I attempt to proceed manually. I estimate my total portfolio value (90% of which is in stocks) and proceed to the next page. I get a pop-up telling me that my portfolio will be treated as an “all cash account”. But it’s not an all cash account. Obviously, you get basically no returns with a cash account. I want to compare my investment account. So the pretty chart that they put together is useless.

I go back. I attempt to connect the account again. No dice. Same error message. So, I follow the instructions – contact support if you have a problem.

Support Sucks – Email bounced twice

After signing up, I got a welcome message from Stronghold. Oh hello, Ajay Gupta. The email is from help@strongholdwealth.com which sounds exactly like who I should email. I type up my simple concern and send it off.

Bounced!

Okay, fair enough. I shouldn’t expect to be able to respond to the welcoming email. It’s usually from some generic account used to set up the auto-responder. I’d recommend a different choice of address – help@ is kind of misleading.

So, I go back to the site and click on the button that says “Ask for help” with a nice little dialog logo next to it. As for user experience, I actually think that I might get a live chat box or at the very least a contact form. Nope. I get an awkward mix between an “About” page and a “FAQ” page. First thing I notice is a big box that says “Fees”. I’ll get to that in a minute.

I’m looking for a way to contact support and I end up looking at the future fees I’ll have to pay if I decide to go further. So I go back to the main page where the useless graph is. There’s a phone number and a “see other help options” link in the navbar. Click and I see this email:

“client.support@ strongholdfinancial.com”

Okay, well it’s longer the “help@” email address, but it’s obviously where my previous email should have been sent in the first place. Copy. Inbox. Forward. Paste. Add the comment, “Please improve your user experience. Below is my issue.” Send.

Bounced!

Are you kidding me?!

I’m done.

Fees are high – go it alone

Back to the About/ FAQ page with a “Fees” button. Click. A new page with one link on it. Really? Just take me straight to the dope. Goodness, I must be picky – but seriously – front-end developers – listen to this rant. People have high expectations. There are too many wonderfully-built websites that people are using everyday. Don’t make me think!

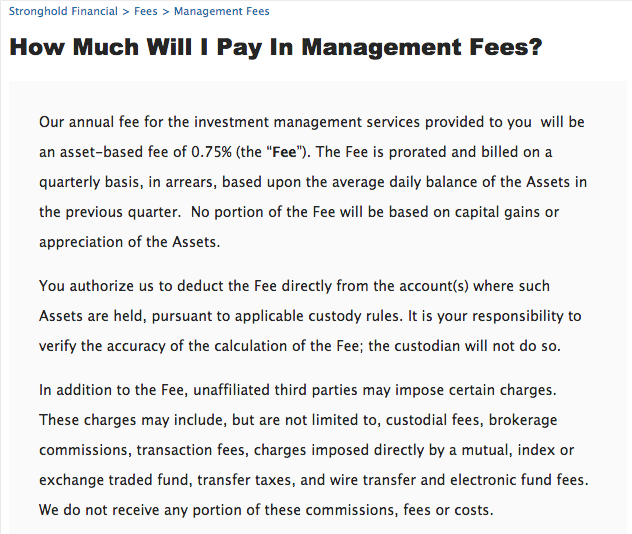

“Our annual fee for the investment management services provided to you will be an asset-based fee of 0.75%”

So the fees are less than 1% which is good. But they are applied quarterly and don’t include possible “custodial fees, brokerage commissions, transaction fees, charges imposed directly by a mutual, index or exchange traded fund, transfer taxes, and wire transfer and electronic fund fees.”

I’m pretty sure Tony’s whole advice is that the financial advisor aspect of the market is ‘fixed’ and that you have ridiculously low odds of beating the market average. Why is Tony recommending people pay Stronghold Financial? I guess because it’s good for the food charities that apparently 1/3 of the profits from the tool will support. You heard that right.

“As Tony mentioned and discloses in the book, he was at one point in discussions with Stronghold in consideration of equity but opted against it. Ajay Gupta, the principal owner has instead agreed to donate 1/3 of future profits to charity. Both Ajay and Tony are passionate about hunger relief.” (Update: Tony is a board member and “has a financial incentive to refer investors to Creative Planning.” See my updated review.)

Translation: Tony was about to profit from this Stronghold Financial tool, but decided it was a bad idea (I agree, Tony – well done). Conflict of interest of course. But Ajay decided to donate 33% of the profits to charity. That’s great, but 100% of that profit is coming out of your potential earnings. Nothing wrong with donating to charity. But the other 2/3rds is funding Ajay’s lifestyle instead of your retirement fund.

Take Tony’s core message to heart. Open a brokerage account on your own with TD Ameritrade, Scottrade, Etrade, Charles Schwab or any other online broker. Invest in SPY or VTI, set up an automatic transfer from your employer and be a millionaire in 40 years. You can use a service like Wise Banyon, which will automatically diversify your holdings based on your risk appetite among seven solid ETF’s for free. (Yeah, people are still scratching their head at how they can survive without a fee but they’re investor-backed and looking to scale first – so get in while it’s hot).

tl;dr: Don’t sign up for Stronghold Financials. You’ll be losing the same fees that Tony Robbins teaches you to avoid.

Disclaimer: The above is obviously my opinion and should be treated as such. I’m not a registered financial advisor. I get a ‘credit’ referral fee for each person who signs up at Axos Invest which I can exchange for tax-loss harvesting on my account, and a few other services. Unfortunately, I can’t exchange them for money. And yes, I own VTI. Make it rain, people.

Thanks for the heads up on Stronghold. My suggestion is to change your TD account password. I’m listening to Tony Robbins’ audio book now (only up to chapter 3) and although there is a lot of sound advice, it seems to be accompanied with a large dose of contradictions, well as some incomplete stories. In one section, he talks about John Templeton’s astronomical returns from buying every stock below $1 on the exchange during the 1939 war time downturn when most investors were bailing out of markets. In a later section he cites Warren Buffet saying no one can time the market. He also talks about Kyle Bass buying a million dollars worth of nickels as a “no risk” investment, but he neglects to mention the cost of storing or insuring those nickels while waiting for the nickels to double in value. That said, although I’m a fairly experienced investor the book is providing me some good ideas where I can strengthen my portfolio and sharpen up my returns.

Good idea, Chuck. Thanks for the balanced review of the book. Can you give any specific ideas you got from the book about how to strengthen your portfolio?

Thanks for your observations which are spot on. If you remember that experts are a bunch of knowledgeable people who can not agree on anything then you will know that he was only echoing.

having said that, acting when things are headed in one direction is not timing the market per-se. Warren Buffet agrees with “Be greedy when others are fearful”. that is not in any way timing the market. None of the experts suggests that we become zombies. No. They kindly shared what helped them succeed. I am glad you fund something to pick up from the book.

Thank you.

I too received the same error msg when I tried to input my UBS account. It took my Ameriprise account and my Fidelity account however with no issues. I’m going to go change my passwords just to be safe. In any regard, it does sound like reducing fees is a big part of how you grow your $$ over the years for sure.

His app does absolute squat too. I like Tony, but he really shit the bed here.

Thank you for your quick experience tale, I’m currently browsing the website of Stronghold and the fact they asked to link my accounts to their system made me back off.

Mint links to accounts. Most of these are ‘read-only”. Why the paranoia?

I was also skeptical about all this, but I did my due diligence and it all checks out. I’ve been a Tony fan for over 20 years and after reading this was in a huff thinking “how could he do this to us” …. but with some basic research turns out this article is subject to quite a few misunderstandings, which is not to insult the writer, but rather to say I was able to quite easily see the opposite of what’s written here.

Also, just one point, I read at one point “Nothing wrong with donating to charity. But the other 2/3rds is funding Ajay’s lifestyle instead of your retirement fund.” …. now…. I’m trying not to laugh, but… with respect, could you find me ONE banker of any sort that does his/her job for free? I respect Tony so much for giving 33% away. That’s more than 99.9% of all other professionals in the industry do.

In a way, this is a great article in terms of raising awareness for people do to their due diligence, but in another way, it’s very poorly written (and not consistent with other incredibly written articles by Shawn).

Hey Adrien, thanks for your polite and thoughtful response. If you’ve funded an account with Stronghold and would like to share your experiences, drop me a note. I’d be happy to have you write a guest post explaining why you like SH.

I too am interested in hearing about real life tales of investing with SHF and what the results were. I’ve considered taking equal amounts of money and investing in SHF and in say, the Vanguard suggested fund and see what happens over a year or two. Can’t quite pull the trigger on it though, given it’s my own money! Oh, also I ran across another ‘robo’ style company that was only .5% versus the SHF .75% but can’t seem to find that one… I suppose could be a third candidate for the comparison, given the SFH has the 4 season approach as differentiator.

Okay, I agree, generally no one works for free. But the point is, in the book Tony describes going to Ajay and challenging him to come up with something FOR FREE, to make available to the average Joe. These people already make plenty of money off of their uber-wealthy clients, and Tony was asking him to throw the little guys a bone. Also, let them give away 33% of their earnings to feed the hungry, and let each of us decide where we want our charity to go (I do believe in giving, BTW; I’d just rather not have Big Brother do it for me). Tony’s book is great–I love what he’s disclosing here–especially about hidden fees eating up all the profits. I’m not finished with reading it yet, but a lot of what he’s revealed so far about mutual funds….isn’t it the same message delivered by David & Tom Gardner through The Motley Fool nearly 20 years ago? We need to take it to heart.

Sarah Stronghold did toss us a bone. The platform is a gift. The 33% to charity is also a gift. here is no signup fee. They charge for the assets they are managing. I can not remember any fees for using the platform to assess your portfolio.

I agree that this article is just trying to ride on the success of Tony Robbins to and Stronghold to sell WB. The author has either not read the book, is not interested in really helping people or is just taking advantage of people that have heard of Tony’s book and are motivated to change. This is an easy distractor after Tony’s book has persuaded people to make a change.

On the issue of 33% donated to nonprofit how much does Shawn Roe donate to charity? What proportion of his profits does he donate?

Adrien, have you been to a Tony Robbins seminar? I am thinking about going. Would be interested to hear your experience.

Maggie, I personally have been to Tony Robbins Unleash The Power Within which was a Three-Day 12 hours a day immersive experience and I walked across 50 feet of 2,000 degrees of hot coals of fire! Life-changing for sure – but I MUST disclose – a woman brought her 9 year old to the seminar so that She could also benefit and when it was almost my turn to walk I started to get nervous about it but when I saw the woman directly in front of me put her 9 year old daughter in place and the little girl did it before me – I realized that I was being foolish for LIMITING what I believed, lol.

When I was crossing on the coals I had a flash second of doubt and when I got hoe that night I noticed that I had a tiny unannoying blister on the bottom of my foot and told myself that when I wake up in the morning it will be gone – AND IT WAS!!

That seminar changed my life and MANY TIMES since then I have healed my body of pain, injuries and even cysts, tumor, Dyslexia, PTSD and to this day I marvel about the incredible power of our Subconscious Mind!

also, keep in mind… besides the Fees at Stronghold, you need to invest or transfer the minimum of $25k… that’s to get started.. however, it looks like Stronghold is the only group that offers the four season portfolio… which is kind a tempting.. I was also checking vanguard.. I guess vanguard seems to be the absolute transparent and cheapest option… the downside of vanguard.. you have no four season portfolio.. and sooo many options.. as a rookie you simple can’t tell where your freaking money goes… would like to invest my maximum amount of 11k for the IRA Roth for this year and last year.. still possible until the 15th of April… so let me know guys.. what you think would be the best to do if I want to put my 11k into the IRA Roth ?

Hey Bernhard – I’d agree with you that as a rookie, Stronghold is not the best option to start off. Despite the benefits of the ‘four seasons portfolio’, you can arguably find similarly safe diversification pretty easily elsewhere.

Right now, if you’re still a bit overwhelmed by Vanguard (which is one of the best places you can put your money), I’d recommend Wisebanyan (WB). Definitely open up a Roth IRA before April 15th to fund it for 2014. As for your risk tolerance – you sound a bit more cautious, so just go through their steps to determine a good allocation for you. Personally, I prefer more growth so I’ve got a 91% stock, 9% bonds portfolio with WB. Drop me a note with your email and I’ll see if I can’t help you ‘skip the line’ at WB.

Thank you Tony awesome stuff from insider.

Don’t you think you should have disclosed that you were getting some sort of referral credit from Wise Banyon?

You’re right. I get a credit from WB for everyone who has signed up. So far, the credits are useless TBH, but it looks like eventually I’ll be able to take advantage of tax-loss harvesting with the credits.

Yet you were knocking stronghold for wanting to make a profit from a service? Can you imagine how much staff they need and how challenging it is for them to set up their platform? I am worried about your approach to these things.

He did disclose this at the end of the article.

Thanks! I am listening to his audio book and all the way googling things as he speaks, and I came across your article. I am only on Chapt 15, but already freaking out that I have a raw deal with an IRA at edward jones (not Roth) in a mutual fund, and wondering what I should do with my 401k from work. Overall what I am understanding from the book thus far is that I want to RUN from mutual funds (hopefully I can pull my $ out of Edward Jones?!) and that I should place my money in a Vangaurd index fund. Is this a correct assessment? BTW I am 32.

Generally speaking, yes. But don’t move before you fully understand why it’s a better move. Mutual funds aren’t bad – just poor-performing ones with higher fees are bad. Index funds (which are technically mutual funds as well that simply track an index) tend to have much lower fees which means you keep more of your money in the fund working for you.

You can definitely pull your money out of your Ed Jones account. You’ll just need to speak with your advisor. It will cost around $100.

Two great resources are the Bogleheads forums (https://www.bogleheads.org/forum/viewtopic.php?t=127166)

and Reddit.com/r/personalfinance (https://www.reddit.com/r/personalfinance/comments/2n0g47/should_i_transfer_my_iras_from_edward_jones_to/)

You’re on your way! Keep researching and learning.

Shawn I do not understand your rationale for freaking out when you got an error message. This is the web, software. Zeros and Ones instructed to carry out action. There will be errors. I am now wondering with you how would you expect the Stronghold tool to help you if you do not trust it enough to even let it see the account it is supposed to advice you on.

while the fees are 0.75% as you were shown, these are DISCLOSED and TRANSPARENT. Also according to Tony Robbins the fees from a REGISTERED FIDUCIARY ADVISER can be claimed at tax time thus effectively it is less than 0.75%!

The disclaimer of fees that they made known on their site alludes to the fact that one may already be engaged with Mutual funds with fees or hidden fees. They are declaring that those charges still apply where they exist.

Thanks for all the information Shawn and for starting the conversation. I am in the same situation as Jessica and have only been with Edward Jones for less than a year. Now I’m learning all this stuff about mutual funds and I’m sick to my stomach. After my divorce I had zero retirement and I’m approaching 50 so I have a lot of catching up to do so that’s why I’m making it my FT job to figure this out and get the best “real” return (as Tony speaks of) not a mediocre “average” return.

I will check out the forum you listed above and also Wisebanyon as you recommend. Is there anything you can recommend in recent months?

Hi ! Can I roll over my full IRA with Merril Lynch to an Index Fund ? My IRA has not made any progress in 10 years sigh

Jessica, this is what I am getting from the book too. Run from mutual funds. Go for index funds. Vanguard is the best. My uncle also recommends Vanguard. He doesn’t know who Tony Robbins is. And he has done very well from himself so that seems positive. The app I tried was so hokey—I am trying to sift what is helpful from what is not. I am 32, as well. I have no additional wisdom. I am a newbie to investing. Wish there was some good solid advice.

OMG Jessica…you’re comment is exactly my situation, except I’m approaching 50. I have been googling things as I am listening to some Tony R youtube videos. I just started investing at Edwards Jones and wondering if I should move over to Vanguard. I see Shawn’s response below and will check out the forums he provided. This is my new FT job…there aren’t enough hours in the day to figure all this stuff out and protect myself and secure a sustainable retirement. After all, I would like to retire comfortably some day :/

I am in the same boat, I am 31. I am with edwards Jones and have an IRA through work. I am confused and will need to re listen to the book again…But it sounds like I should leave. As is the rules with Edward jones/government just changed and I was forced to keep my funds where they are and I can’t ad to them or move them to a new “plan” – all over my head if you ask me. CONFUSING I wish I understood better. It’s like anther language. I wish there was something that made it a little easier to understand.

“Tony Robbins is NOT an owner of Stronghold nor does he receive any direct or indirect compensation from Stronghold.” Yeah well does he receive any compensation from a third party such as an insurance company? And notice that “receive” is not a past tense verb. Maybe he already RECEIVED compensation! This one smells like a rat!

I read this book (listened) three times and can easily say that I would give 4.5 stars out of 5. I love his life principals and passion too.

However Tony’s website tonyrobbins.com is falling waay short of the book. You feel like someone is begging for money. Please buy this, buy this and also this too. This is ridiculous. NO customer support at all. I was charged $99 as fraudulent and they sent me his book two times.

Really great post! I’m going through Tony’s book now (25% through) and started googling to see what people were saying about the information. I’ve been invested in mutual funds since 05 and have tried to learn more about investing a few times throughout the years to no avail. My investment advisers speak in a language that I never could wrap my head around. Finally, thanks to this book, I’m actually started to wrap my head around these concepts. But before I got too exited, I need to see if this information is valid. I have never heard anything remotely close to this since 05. Sounds like the info in the book about mutual fund fees is largely on point, he’s just trying to sell me on these companies he keeps name dropping over and over again. Which is fine, I can deal with that, as long as the info is mostly correct. The mutual fund fees really through me for a loop. I’m still recovering actually. I’ve been getting my ass waxed for years and had no clue. I’m really thinking hard about these robo-advisers. It seems like they are doing what Tony recommends in the book, creating a diverse portfolio of low-cost ETF index funds. I’d rather pay them the low fees they charge and not have to architect my own portfolio if these robo-advisers are actually legit. Sounds like you’re a fan of them. Would you recommend going with them instead of trying to come up with a portfolio based on knowledge like that contained in Tony’s book? Full-disclosure, I’m still (unfortunately) very much a noob at this even though I’ve been at it for a while. I love to learn, however, and now that I have some info I may be able to sort it out myself with a few months of effort. But if robo-advisors would handle it for me, I do have other passions I’d rather spend my time on.

Thanks!

Folks, one important concept I got from reading Tony’s book was to balance your portfolio 1-2 times per year to maintain your original risk ratios. What I don’t quite get is how you avoid selling shares too quickly to avoid taxes (capital gains). Fidelity 401k does not seem to break this down. In general, I’m open to suggestions on recommended books that explain how to manage the actual account. Even if I get a fiduciary, I want to be able to quiz her periodically. Thanks.

I see you tried to e-mail support at HELP@StrongholdWealth.com

Internet WhoIS shows that that domain is not owned by anyone.

The company name is StrongholdFinancial.com

You may want to be more careful.

Also, their website has online chat now and does not provide an e-mail support, but instead provides a help submitting form.

WhoIS:

https://www.godaddy.com/domains/searchresults.aspx?prog_id=GoDaddy&ci=4853&checkAvail=1&dpp_itc=dpp_whois&domainToCheck=strongholdwealth&tld=com

Thank you for helping me avoid financial disaster.