The easy way to beat 90% of professional investors is to invest that money in low cost index funds through ETF’s. That’s it. That’s all you need to know. It took me 10 years to learn this, but when I figured it out and back tested it, I laughed at how obvious and simple it is. Then I wondered why no one was teaching this. This should be taught in middle school and retaught in high school. So I vigorously scoured the internet and sure enough, tons of intelligent, respectable advisors and financial magazines tout the benefits of index investing and how professional fund managers don’t “beat the market”. And when professional investors say don’t “beat the market”, the market = index funds. It all seems so obvious, yet for some reason it’s not. So I’m here to bring the obvious to light. It’s index funds all day long, baby. Follow this advice and you’ll be earning money like those wealthy 1% who pay less tax than you. If you can’t beat ’em, invest in them!

The easy way to beat 90% of professional investors is to invest that money in low cost index funds through ETF’s. That’s it. That’s all you need to know. It took me 10 years to learn this, but when I figured it out and back tested it, I laughed at how obvious and simple it is. Then I wondered why no one was teaching this. This should be taught in middle school and retaught in high school. So I vigorously scoured the internet and sure enough, tons of intelligent, respectable advisors and financial magazines tout the benefits of index investing and how professional fund managers don’t “beat the market”. And when professional investors say don’t “beat the market”, the market = index funds. It all seems so obvious, yet for some reason it’s not. So I’m here to bring the obvious to light. It’s index funds all day long, baby. Follow this advice and you’ll be earning money like those wealthy 1% who pay less tax than you. If you can’t beat ’em, invest in them!

Proof is in the pudding – Had Mr. Trump invested in index funds (instead of real estate), he’d be twice as rich. Sucker!

What’s an index fund?

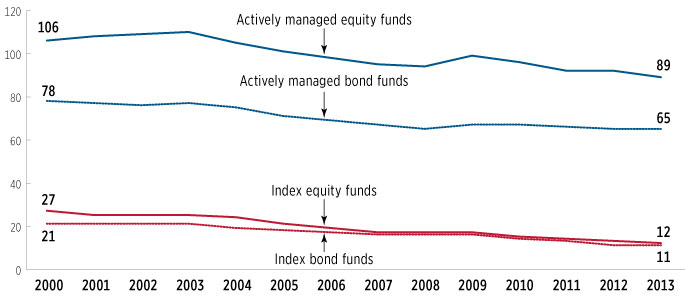

An index fund is an investment in a whole bunch of companies as a group. The point of an index fund is to replicate (or track) the returns of a specific market. It can be a mutual fund or an ETF. The cool part about an index fund is that it doesn’t need to be actively managed because it follows a set of specific rules for it’s investments. A computer can do it which means you don’t have to pay a manager big fees. This usually results in lower fees for index funds as compared to other mutual funds. The average expense ratio of index funds is 0.12% while the average mutual fund expense ratio is 0.89%. The fees for mutual funds are more than 7 times more expensive than index funds. This is why I invest in low cost index funds. That money you save in fees can go right back into your investment and grow your money even faster.  source

source

What’s an ETF?

An ETF is an exchange-traded fund, which basically means a fund holding a whole bunch of individual companies but traded easily as one (symbol). It’s essentially a fund (usually an index fund) and can be traded throughout the day. Like a fund, it holds positions in multiple assets (in our case – multiple stocks). So why should you invest in this ETF index fund thing? Ultimately, because it offers you, as an investor, the best chance for earning the highest returns with the least amount of risk. ETF’s are easy to purchase, have low costs, and give you immediate diversification – all things you want in an investment. ETF’s are easy to buy and sell because you can trade them just like any other stock. Simply put in a buy or sell order with your broker and that’s it. Index funds allow you to own stock in multiple companies by only making one trade. Brokers usually charge per trade, so if you wanted to buy 100 different companies you’d have to pay the trading fee 100 times. Even a low-cost broker only charging $5 will add up to $500 to buy all those stocks. Own those same 100 companies through an index and you pay only one time – $5 in this example. So, are you ready to get in the market and start earning money for your retirement, next house, or child’s college fund? Yeah, me too. So, let me show you how to open a brokerage account online so you can start DIY investing.